September 2025

- James Kim

- Oct 1, 2025

- 8 min read

North America

·RXR launches Gemini, a multibillion-dollar venture, to acquire premier New York office properties with backing from The Baupost Group and Liberty Mutual. RXR Realty, a leading New York-based real estate developer and investor known for owning iconic properties such as 590 Madison Avenue, has launched Gemini, a multibillion-dollar investment venture focused on acquiring top-tier Manhattan office buildings. The venture targets Class A office assets with strong corporate tenant demand and limited new supply, driving low vacancy rates in prime locations like Park Avenue. Gemini’s initial portfolio exceeds $3.5 billion and includes the $1.08 billion purchase of 590 Madison Avenue and a 49% stake in 1211 Avenue of the Americas, which houses News Corp and Fox Corp. RXR also led a $1.1 billion recapitalization of Starrett Lehigh, a major office and retail complex in Chelsea. CEO Scott Rechler highlighted that pandemic-related shifts and increased return-to-office demand have created generational buying opportunities. The Gemini venture offers institutional investors liquidity by allowing them to exchange legacy office holdings for stakes in RXR’s diversified, high-quality portfolio. This effort is backed by strategic investors like The Baupost Group and Liberty Mutual, underscoring confidence in RXR’s strategy to capitalize on New York’s evolving office market. (Source: RXR Realty, CoStar, 2025)

RXR Realty is based at 75 Rockefeller Plaza in New York.

·CMBS lenders face largest loss of 2025 amid office and retail distress. CMBS lenders recorded their biggest loss this year with the retail portion of the former New York Times headquarters at 229 W. 43rd St. selling for $28 million, a steep drop from its $470 million appraisal in 2016. Nationwide, about 250 CMBS-financed properties have loans exceeding appraised values, with an average loan-to-value ratio of 192%, showing widespread overleverage. In Philadelphia, four major office buildings on Market Street totaling 3.7 million square feet are tied to CMBS loans totaling $836.2 million, yet their combined appraised value has fallen to $661.8 million — significantly below the debt load. The loan portfolios are under severe stress with all these loans currently in special servicing due to payment difficulties. Key properties include the 1500 Market St. complex, recently foreclosed and being repositioned for redevelopment, while 1515 Market St. has reached preliminary loan modification terms to extend maturity. Meanwhile, 1700 Market St. faces a scheduled foreclosure in March 2026, and 1818 Market St. is in receivership. Vacancy rates in this district are approaching 25%, with rents stagnant near $36 per square foot since early 2021, underscoring weak demand and refinancing challenges. Across the broader CMBS sector, high debt levels, maturing loans, and increasing defaults reflect ongoing turbulence, but special servicers’ active management could present investment opportunities. (Source: CoStar, Philadelphia Business Journal, 2025)

1500 Market St. in Philadelphia lined up for sale by court-appointed receiver, CBRE, following foreclosure.

·SL Green secures $1.4bn refinancing at 5.8% for historic Manhattan tower. SL Green Realty and its partner PGIM have closed a $1.4 billion refinancing on 11 Madison Avenue, a landmark Art Deco office tower in Manhattan’s Flatiron District. The five-year CMBS loan, carrying a fixed rate of 5.8%, was originated by a syndicate including Wells Fargo, JP Morgan Chase, Bank of America, and Goldman Sachs, and matures in 2030. At 2.3 million square feet, the iconic full-block property houses major tenants such as UBS, Sony, Suntory, and the Michelin-starred restaurant Eleven Madison Park. Occupancy levels have remained exceptionally strong, averaging 97.5% over the past two decades, with 87% of rent paid by investment-grade tenants. The refinancing deal ranks as the third-largest CMBS office transaction in the U.S. this year, highlighting investor demand for prime, well-leased Manhattan assets. Recently, Pinterest doubled its New York footprint with a new lease in the building, further strengthening the tenant mix. According to Moody’s, the property would draw significant national and international investor interest if brought to market. (Source: CoStar, SL Green, 2025)

11 Madison Avenue is one of just 32 office buildings that directly face a park in New York

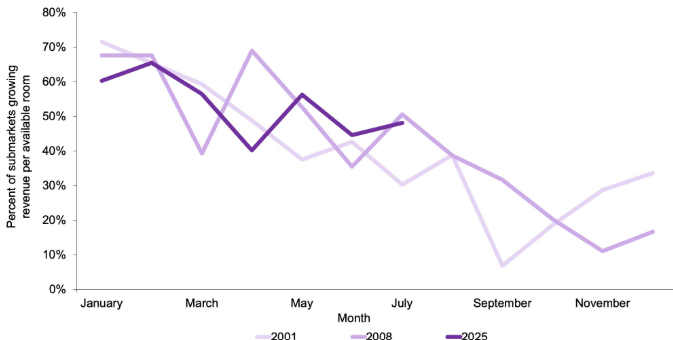

·US hotel submarkets show signs of downturn as RevPAR (Revenue per available room) growth slows. The U.S. hotel industry is showing signs of weakening as more submarkets record declines in revenue per available room (RevPAR). Of the nation’s 691 hotel submarkets, only 48% posted year-over-year RevPAR growth in July 2025, down from 60% in January, meaning over half are now in decline. This trend mirrors patterns seen during prior recessions, when submarkets shifting from growth to decline foreshadowed broader downturns. In 2001, RevPAR growth plunged from 71% in January to just 7% in September following the 9/11 attacks, while in 2008 it fell from 68% in January to 17% by December. For 2025, RevPAR is projected to dip 0.1% nationally, reflecting softer group bookings, uncertainty among business travelers, and slowing leisure demand. These pressures suggest further deceleration across submarkets, raising concerns of a repeat trajectory resembling the 2001 and 2008 downturns. For investors, this signals heightened risks in weaker-performing destinations while highlighting the resilience premium for top-tier markets. (Source: CoStar, National Bureau of Economic Research, 2025)

Percentage of US submarkets with growing monthly RevPAR decline in-line with 2001 and 2008.

·US apartment rent growth slows with sharp local divergence driven by supply-demand dynamics. In August 2025, U.S. apartment rents declined nationally by 0.23%, reflecting the second straight month of flat or negative growth and slowing annual rent increases to 1.0%. While all regions posted declines, local markets diverged sharply due to differing supply and demand conditions. Coastal California cities like San Francisco and San Jose saw strong rent growth (6.2% and 3.5%) driven by limited new supply and sustained demand. In contrast, markets such as Phoenix and Denver faced rent decreases amid higher new apartment construction and a post-pandemic migration correction. The South showed mixed results, with Richmond and Norfolk performing well due to constrained supply, while Austin and San Antonio saw steep rent drops due to oversupply and softer demand. The Midwest and Northeast remained stable, with steadier supply pipelines supporting consistent rent growth and limiting volatility. This divergence highlights that local supply-demand fundamentals, particularly new construction activity and migration patterns, are critical for investors assessing multifamily rental opportunities. (Source: CoStar, 2025)

Market performance by region

Europe

·Capreon and Hayfin secure London’s iconic 70 St Mary Axe at 5.6% yield, outbidding Blackstone’s previous 6% offer. Nuveen has agreed terms to sell 70 St Mary Axe, a prominent 300,000 sq ft multi-let office tower in the City of London, to a joint venture between Capreon and Hayfin Capital Management for approximately £340m, reflecting a yield of 5.6%. This offer surpasses Blackstone's earlier bid of £322m, which implied a 6% yield before Nuveen's investment committee withdrew the asset amid softer market conditions. Capreon, controlled by the Noé family, will act as operating partner while Hayfin provides the majority of the equity. The building benefits from a passing rent of £68.30 per sq ft and tenant leases averaging seven years, underpinning stable income. The deal highlights Capreon's growing footprint in the London office market following its £50m Farringdon acquisition last year and signals renewed confidence among institutional investors in prime London offices. The transaction awaits final approval from Nuveen's investment committee. (Source: Green Street, 2025)

Capreon and Hayfin’s acquisition of 70 St Mary Axe shows sign of recovery for London office market

·Dominus set to acquire distressed City of London office at loan par value of £80m, well below Henderson Park’s £120m purchase in 2019. Developer and investor Dominus is in advanced negotiations to acquire Ibex House, a 190,000 sq ft art deco City office, for approximately £80m from lender BNP Paribas. The transaction price represents the outstanding loan balance, marking a significant discount to the £120m Henderson Park paid for the asset in 2019. BNP Paribas took control of the property earlier this year after Henderson Park breached loan covenants, with Covid-19 disruptions and planning delays derailing the original refurbishment plans. The 1937-built property occupies a prominent island site near Tower Hill and Aldgate stations, offering potential for residential or hotel redevelopment. Dominus, which has four London hotels comprising over 1,200 rooms in its development pipeline, sees the acquisition as fitting its strategy of hotel conversions and operational real estate. The deal underscores continued distress in the London office sector, with lenders seeking to exit positions at loan levels rather than pursue lengthy workout processes. (Source: Green Street, 2025)

Dominus set for residential or hotel redevelopment at Ibex House.

·Bain Capital leads EUR 300m acquisition of Pullman Paris Montparnasse hotel. Bain Capital, alongside Columbia Threadneedle and QuinSpark Investment Partners, has completed the €300 million acquisition of the 957-room Pullman Paris Montparnasse from Unibail-Rodamco-Westfield, valuing the four-star asset at over €315,000 per key. The 32-storey property, located next to Montparnasse station in Paris’ 14th arrondissement, underwent a €216 million renovation in 2021, making it one of the most modern large-scale hotels in the city. As the largest Pullman in Europe, the hotel offers oversized rooms, extensive meeting and events space, restaurants, a sky bar, and potential for further amenities such as a spa. For Bain Capital, the deal reflects its strategic expansion into the European hospitality market, where it sees long-term structural demand in supply-constrained urban centers. The group views current macroeconomic conditions as a rare opportunity to acquire trophy assets in cities like Paris, positioning this investment as a flagship example. (Source: Columbia Threadneedle, Bain Capital, CoStar, 2025)

Bain Capital’s JV with Columbia Threadneedle and QuinSpark acquires the Pullman Paris Montparnasse, in the 14th arrondissement of Paris.

·BNP Paribas REIM suspends value-add strategy fundraising. BNP Paribas REIM has suspended fundraising for its new value-add strategy after failing to secure sufficient equity commitments. The Paris-based manager, traditionally focused on core real estate, had seeded the fund with €100 million of its own capital and raised €25 million from an institutional investor before halting marketing in August. Market sources said investors were hesitant due to BNP Paribas REIM’s limited track record outside the core space, while BNP Paribas Cardif’s €5.1 billion acquisition of Axa Investment Managers also dampened appetite. The strategy, launched at the end of 2024, was designed to diversify portfolio exposure into residential, logistics, healthcare, hotels and leisure while selling off non-strategic assets. The pause highlights the challenging fundraising climate, with Preqin data showing global fund closes declining and average fundraising timelines now at record highs of 24 months. While a few major players such as BlackRock continue to draw capital into established value-add platforms, new entrants in the segment are finding it particularly difficult. BNP Paribas REIM has not commented on whether the strategy will be revived, and continues to focus on its core funds, including the European Impact Property Fund and Healthcare Property Fund Europe. (Source: Preqin, Green Street, 2025)

Funds in Market

·Davidson Kempner, global multi-strategy investor, targets undersupplied European logistics, data centres, and nice housing. Davidson Kempner is focusing on investments in undersupplied European sectors like logistics, data centres, and operationally intensive residential assets, especially in Italy and Portugal, where yields and complexity offer attractive returns. The firm favors markets with clear supply-demand imbalances and limited competition, leveraging falling construction costs and rising rents to maximize value in logistics. Growing demand for data centres, driven by projected capacity increases, positions this sector as a priority for large-scale capital allocation. In hospitality, Davidson Kempner sees opportunity where financing gaps and scarce hotel development create value, especially for hands-on investors. Niche residential assets like single-family rentals and senior housing are targeted for their complexity and supply shortages, offering distinctive value-add opportunities. Their multi-strategy approach allows flexible investment in both debt and equity, enabling them to capitalize on special situations and distressed asset recapitalizations in the new European market cycle. Overall, they are pursuing markets and asset types where competition is lower and operational improvements can drive superior returns for investors. (Source: Davidson Kempner, Green Street, 2025)

Romain Ferron, Real Estate Partner at Davidson Kempner, focuses on their European value-add and opportunistic strategies

Comments